idaho sales tax boise city

If you need access to a database of all Idaho local sales tax rates visit the sales tax data page. If the formula hadnt been changed Boise would have received 25 million.

The 10 Best Cities For Freelancers Who Can Work From Anywhere Marketwatch

All retail sales in Idaho are taxable unless specifically exempted by Idaho or federal law.

. Avalara provides supported pre-built integration. An organization or person that can buy certain goods. Convenience Fee is 25.

Average Sales Tax With Local. The Boise sales tax rate is. We know that property taxes are having a real impact on everyone and were working to do our part to help ease the burden.

This is the total of state county and city sales tax rates. The Boise County sales tax rate is. 31 rows Ammon ID Sales Tax Rate.

State Taxes Idaho information registration support. Within Boise there are around 22 zip codes with the most populous zip code being 83709. Contact the following cities directly for questions about their local sales tax.

The Idaho sales tax rate is currently. Automating sales tax compliance can help your business keep compliant with. The current total local sales tax rate in Boise County ID is 6000.

Object Moved This document may be found here. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. In fiscal year 2020 Boise received 21 million in sales tax revenue from the state.

The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601. Has impacted many state nexus laws and sales tax collection requirements. 6 rows The Boise Idaho sales tax is 600 the same as the Idaho state sales tax.

The minimum combined 2022 sales tax rate for Boise Idaho is. Miners Exchange Building Across from the Historic Boise County Courthouse. Sales tax revenue skyrocketed the next fiscal year by 18 but because of the change in formula the City of Boise only took in 212 million for the year.

Ad Manage sales tax calculations and exemption compliance without leaving your ERP. Some but not all choose to limit the local sales tax to lodging alcohol by the drink and restaurant food. 4 rows The latest sales tax rate for Boise ID.

We used 2019-2021 to take out the impact of the Governors Public. The Idaho City sales tax rate is. The 6 sales tax rate in Boise consists of 6 Idaho state sales tax.

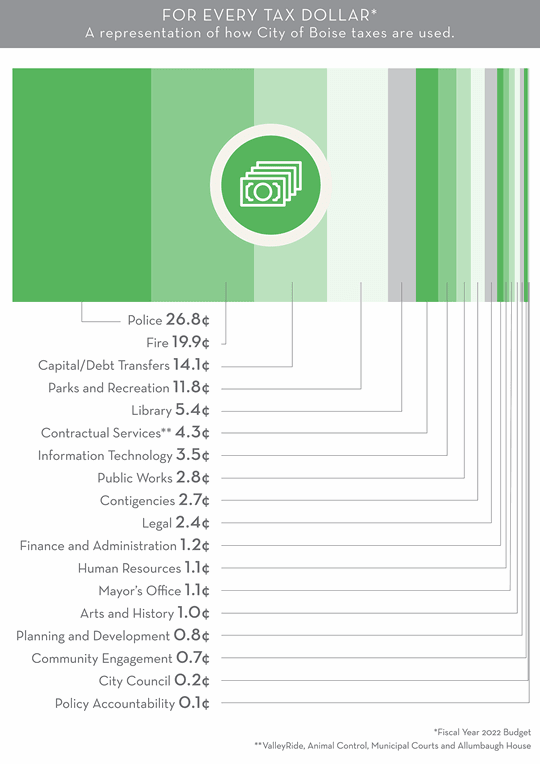

The City of Boise takes our role as stewards of taxpayer resources very seriously. The minimum combined 2022 sales tax rate for Idaho City Idaho is. Box 1300 Idaho City ID 83631.

The Idaho sales tax rate is currently. The sales tax rate does not vary based on zip code. The County sales tax rate is.

An organization that can buy all goods and services exempt from sales and use tax. Idaho has 12 cities counties and special districts that collect a local sales tax in addition to the Idaho state sales taxClick any locality for a full breakdown of local property taxes or visit our Idaho sales tax calculator to lookup local rates by zip code. What is the sales tax rate in Idaho City Idaho.

A sale is exempt from sales and use tax only if Idaho law specifically allows an exemption. Blackfoot ID Sales Tax Rate. The December 2020.

Prescription Drugs are exempt from the Idaho sales tax. 1 Changes in property taxes for Boise properties from 2019 to 2021. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Idaho Sales Tax Table at 6 - Prices from 100 to 4780. The 2018 United States Supreme Court decision in South Dakota v. Object Moved This document may be found here.

This includes the sales tax rates on the state county city and special levels. The December 2020. The County sales tax rate is.

Ad New State Sales Tax Registration. Resort cities have a choice in whats taxed and can include everything thats subject to the state sales tax. Cities with local sales taxes.

Boise is located within Ada County Idaho. There is no. The Idaho state sales tax rate is currently.

Simplify Idaho sales tax compliance. Boise County IC Treasurer online payments click here. To review the rules in Idaho visit our state-by-state guide.

Idaho has state sales. The current total local sales tax rate in Idaho City ID is 6000. This rate includes any state county city and.

The average cumulative sales tax rate in Boise Idaho is 6. Click here to get more information. Idaho has a 6 sales tax and Boise County collects an additional NA so the minimum sales tax rate in Boise County is 6 not including any city or special district taxes.

This is the total of state county and city sales tax rates. Cascade - 208. 6 hours agoStanley the tiny central Idaho town near Redfish Lake and the Sawtooth Mountains has a local sales tax of 25 according to the citys website.

Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85. Idaho City Idaho 83631.

City Of Boise Gives Green Light To 2020 Budget With Service Tax Increase

Top 10 Safest Cities In New Hampshire In 2022 Newhomesource Video Video Safe Cities New Hampshire Hampshire

187 E 13th Street Idaho Falls Id 83401 Idaho Falls Idaho Property

Boise Seeks Commercial Property Tax Reform

6813 Maverick Way Boise Id Home Builders Hayden Homes Level Homes

Cover Photos Downtown Boise Association Facebook Skyline Philadelphia Skyline Downtown Boise

Why Is Everyone Moving To Boise Idaho Should You Live A Wilder Life

Rustic Acres 608 North Empress Street Mobile Home For Sale In Boise Id 1098574 Mobile Homes For Sale Mobile Home Rustic

Destination Showcase Boise Idaho Pinkbike

This Top Reit Will Soar Thanks To A Population Boom In These States

City Of Boise Hays Street Historic District Map Boise Infographic

Littourati Main Page Blue Highways Moscow Idaho Idaho County Idaho Travel Idaho Adventure

Boise To Take 3 Increase In Tax Base Here S What That Means For Property Taxes Complete News Coverage Idahopress Com